Reuse packaging company, Reuseabox, announced as a finalist for the Small Business awards.

Reuseabox has been shortlisted for Britain’s best ‘Net Hero’ business.

Read MorePlease note this article was published on 23rd March 2020 and may be out of date. For the latest information about financial support around Coronavirus, please click here

The Covid-19 Coronavirus is causing chaos across the country, with many working from home and businesses forced to temporarily close down.

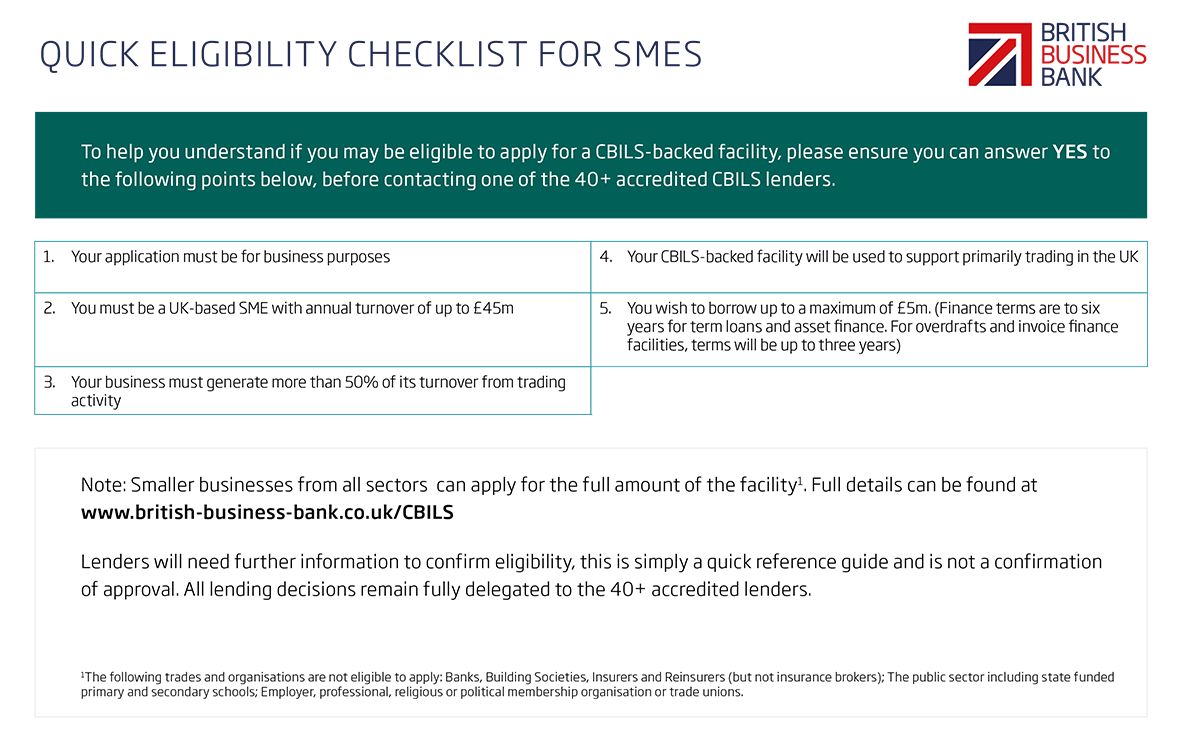

CBILS is a new scheme that can provide facilities of up to £5m for SMEs who are experiencing lost or deferred revenues, leading to disruptions to their cashflow. CBILS supports a wide range of business finance products, including term loans, overdrafts, invoice finance and asset finance facilities.

This scheme is now live and provided by the British Business Bank through participating providers. All 40+ accredited lenders will be ready to provide CBILS today (23rd March 2020).

Click here to find out more about this scheme and apply.

Reuseabox has been shortlisted for Britain’s best ‘Net Hero’ business.

Read MorePAB Languages Centre, a leader in providing comprehensive language solutions, has been named as a supplier on the KCS Procure...

Read MoreLog into your account